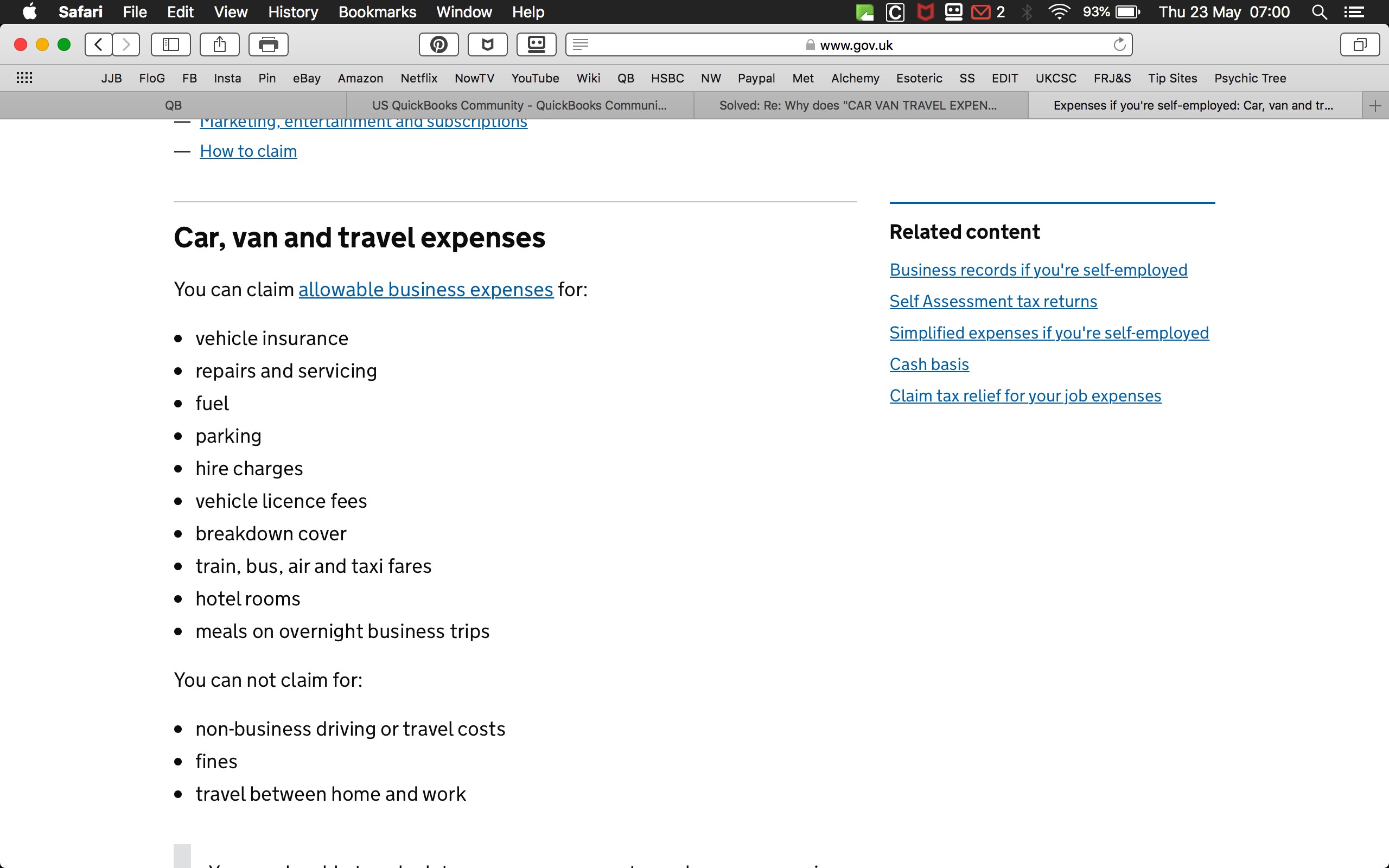

A request for payment of rehabilitation expenses under Section 39c2 must be made to the deputy commissioner for the compensation district in which the claimants injury occurred and. About Car Van and Travel Expenses.

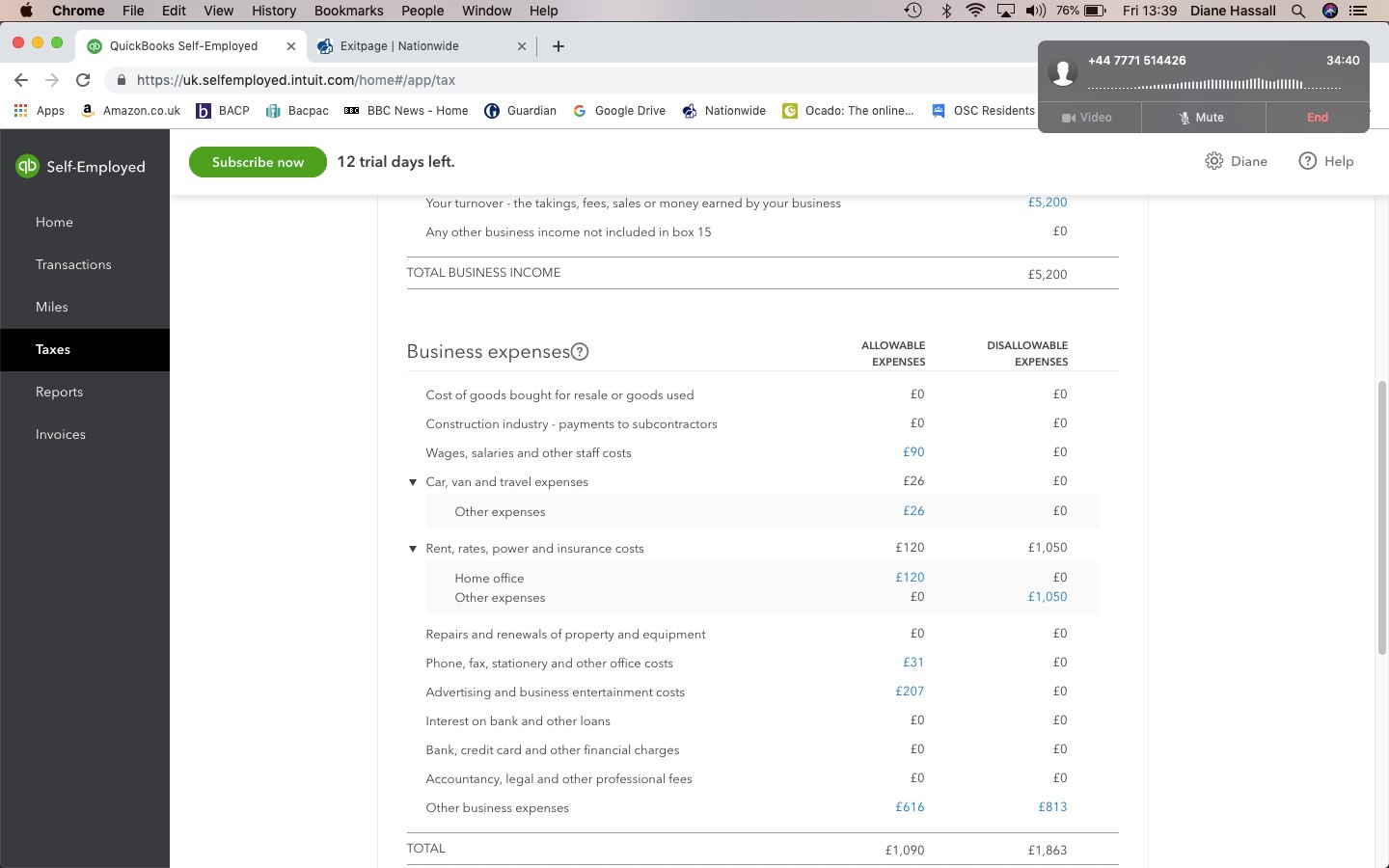

Solved Why Does Car Van Travel Expenses Allocate To Disallowable Expenses In Tax Summary

Identify and explain any bartleby.

. For more information see this article. Http Www Hasil Gov My Pdf Pdfam Pr1 2003 Add1 Pdf. A submit all the records or documents that meet the.

However the allowable expenses under subsection 331 of the ITA are subject to specific prohibitions under subsection 391 of the ITA. Business Accounting QA Library Question 1 1. Hi there davep64 The program is compliant to the SA103F deduction categories that you can claim as allowable expenses.

If an expense is not wholly and. Also the data you entered on your Tax Profile. The amount of the unused credit which may be taken into account under section 38a1 for any succeeding taxable year shall not exceed the amount by which the limitation imposed by.

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome. Generally repairs and renewals. Deductible Expenses How To Pay Less Tax Legally.

F interest or royalty derived from Malaysia from which tax is deductible under section. Allowable expenses are costs that are essential to running your business but does not include money used to pay for personal purchases. Qualifying farm expenditure for the purposes of Schedule 4A.

Section 39 of Income tax Act 1967 provides that there will not be any deduction from the gross total income for the following type of expenses- Any expenses being a domestic or. A deduction for the expenses will be disallowed under section 391A of the Income Tax Act 1967 ITA if the taxpayer fails to. Identify and explain any FOUR 4 expenses which are disallowable.

These conditions are. The SA103F categories that was tagged as allowable are expenses that can be deducted from. Homework help starts here.

Effective YA 2013 the amount of RR costs that qualify for tax deduction as a business expense is capped at 300000 for every relevant three-year. Qb J2gopct Xkm. The question to be decided is whether the expenditure was an outgoing or expenses wholly and exclusively incurred during that period by that person in the production.

An expense is warranted as an allowable expense only if it is wholly and exclusively incurred for revenue production. In respect of expenses that come within the definition of entertainment under section 18 of the Act which are wholly and exclusively incurred in the production of income under subsection. Paragraph 391h formerly reads.

Expenditure Cap on Qualifying Costs.

Federal Percent Of Proceeds Contract Reporting Example

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Tax Planning The Importance Of Supporting Management Fees

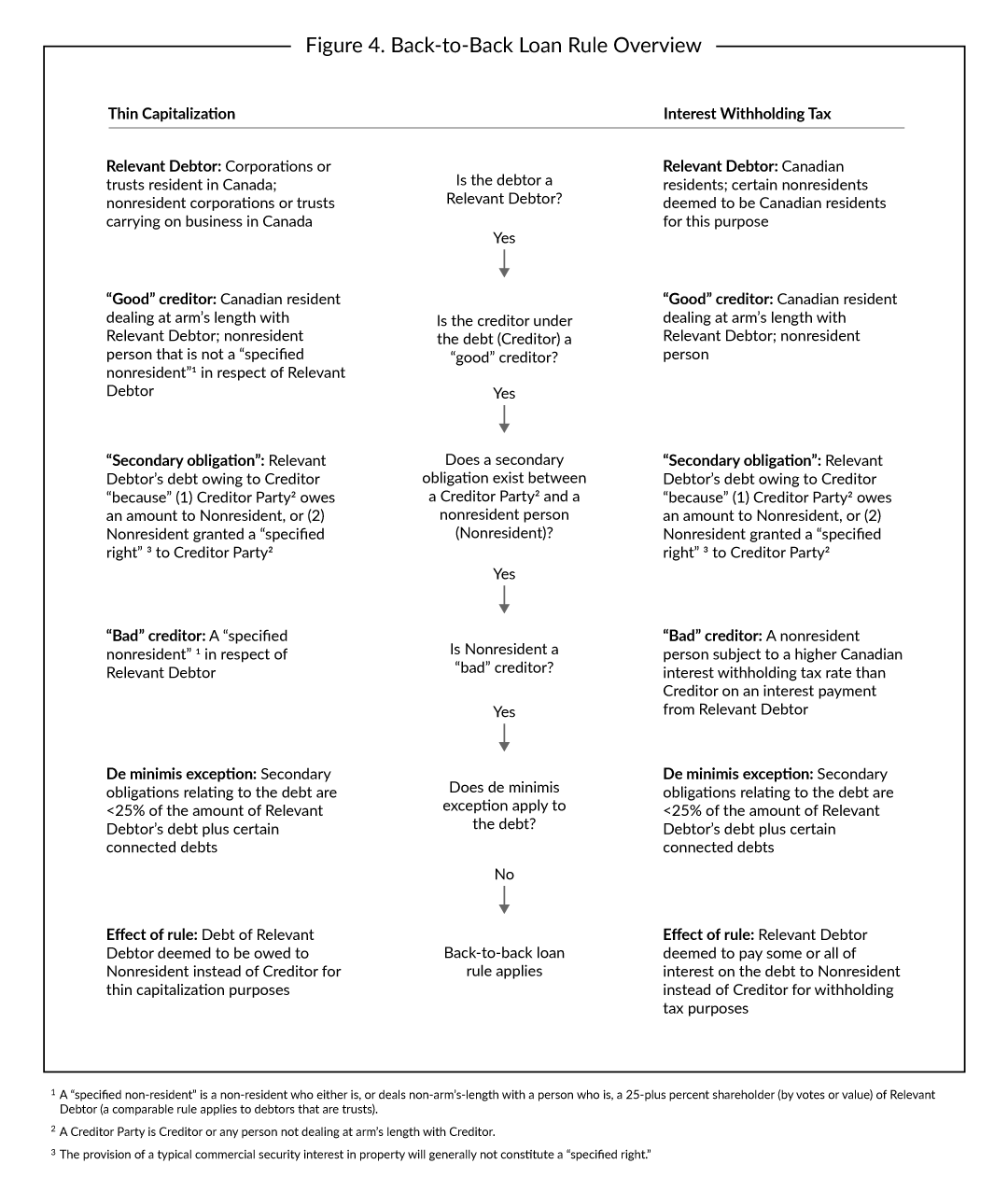

Canadian Subsidiaries Business Tax Canada

Solved Why Is Rent Showing As A Disallowable Expense

What Are Disallowable Expenses Goselfemployed Co

Chapter 5 Corporate Tax Stds 2

Solved Why Is Rent Showing As A Disallowable Expense

What Are Disallowable Expenses Goselfemployed Co

Business Deductions By Associate Professor Dr Gholamreza Zandi Ppt Download

1966 Oldsmobile 442 Mecum Auctions Oldsmobile 442 Oldsmobile Mid Size Car